The importance of having a good inventory turnover ratio To calculate the average number of days it takes to turn the stock concerned, we divide 365 days by the 5.4 turns, obtaining the result of 68 days: Using the inventory turnover calculation we get 5.4 turns per annum: At the end of this period, the stock was valued at £163,000 and the opening value was £140,000. The cost of goods sold over this period was £815,000.

#Turnover formula windows

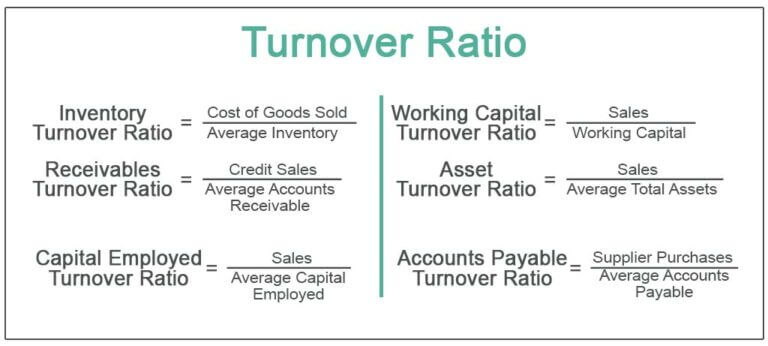

The ABC Doors and Windows Company wanted to calculate its inventory turnover for the last 12 months. Let’s look at an example for a company in the building materials industry. Here’s an example of the inventory turnover calculation: Average inventory value is calculated by adding your opening inventory value to your closing inventory value and dividing by 2. The inventory turnover ratio is calculated by taking the total cost of goods sold (COGS) over a specific time period and dividing it by the average inventory value during the same period. How do I calculate inventory turnover ratio? The inventory turnover ratio is defined as the ratio of cost of goods sold to the average stock held. It is often used to measure the efficiency of warehouse or stock control processes. Inventory turnover ratio (also known as stock turn) is an accounting and inventory management KPI used to measure how many times stock is sold (used or replaced) within a fixed period of time. If your business has an annual turnover above £85,000, then it’s a legal requirement to register for VAT.Inventory turnover (also known as stock turnover) is a measure of how well a business manages its inventory. However if you have one invoice that needs paying, you’ll usually need to send a late payment letter.īy working out your turnover, you’ll know if you need to register for value added tax (VAT). If you have customers who have several invoices over a short period of time, sending them a statement of account could remind them what they owe. If customers don’t pay you on time, your annual turnover or profit could be lower than expected. Unfortunately, late payments are a problem for many small businesses. Increase turnover with a statement of account You can also do a break even analysis to work out when you can expect to make a profit.

#Turnover formula how to

For example, are there savings you can make on administrative expenses? Or are you sure that you’re claiming all your business’s allowable expenses?įor more ways to carry out a business health check, find out how to do a balance sheet, or use our budget calculator for the self-employed.

If your net profit is low as a proportion of your turnover, you might look at ways to make your business more efficient. If your gross profit is low compared with your turnover, you might want to look at ways to reduce the cost of your sales – for example, by renegotiating contracts with suppliers. It’s important that business owners understand their turnover, mainly so they can work out what they need to bring in to meet their target profit. Turnover meaning for businesses – why is it important? Our article discusses turnover as it relates to your business income. A low inventory turnover means sales could be slow, while a high inventory turnover could indicate a strong sales performance. Turnover can also be used to describe how often your inventory or stock is replaced. Or, if you offer credit to customers or clients, you might also measure ‘accounts receivable turnover’ – the length of time it takes your customers to pay. For example, ‘turnover’ can also mean the number of employees that leave a business within a specific period, also sometimes known as the ‘employee churn rate’. There are also a few other potential definitions of turnover that don’t refer directly to your finances. Knowing your turnover figure is useful throughout the whole life of your business – from planning and securing investment, through measuring performance, to valuing your company if you plan to sell. It’s an important measure of your business’s performance. This is different to profit, which is a measure of earnings. It's sometimes referred to as ‘gross revenue’ or ‘income’. Turnover is the total sales made by a business in a certain period. So how do you work it out? This article explains what business turnover is, in simple terms, and guides you through calculating it. But while business turnover is a useful measure of success, it's often confused with profit.

0 kommentar(er)

0 kommentar(er)